By John Eichberger

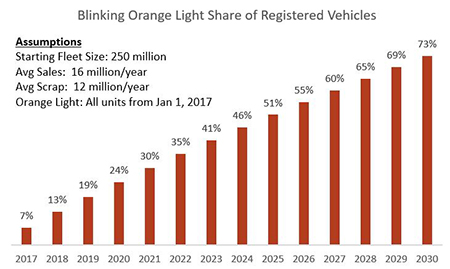

ALEXANDRIA, Va. – In our previous “Are We There Yet?” story, we introduced the concept of using simple, cocktail napkin math to evaluate how long it takes to turn over the vehicle fleet. We used static numbers for sales and vehicle scrappage, and calculated that if every vehicle sold from January 1, 2017, was equipped with a blinking orange light on the dash, by 2030 market penetration of the fleet would reach 73%.

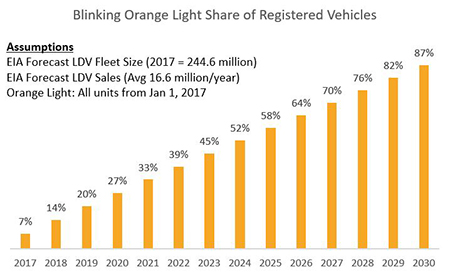

After we finished our cocktails and recycled those napkins, we started thinking: What if the numbers are not static? What effect would that have? So, we pulled U.S. Energy Information Administration (EIA) forecasts for sales and registered vehicles through 2030 and applied the same approach.

After we finished our cocktails and recycled those napkins, we started thinking: What if the numbers are not static? What effect would that have? So, we pulled U.S. Energy Information Administration (EIA) forecasts for sales and registered vehicles through 2030 and applied the same approach.

Assuming every vehicle sold since January 1, 2017, was equipped with our blinking light, the market penetration in 2030 increased to 87%. This change is because EIA forecasts annual average light-duty vehicle (LDV) sales of 16.6 million units, which is 0.6 million greater than our original estimate, and their starting fleet size and scrappage rates were different than our original estimates. But, it shows that even when every vehicle is converted immediately, it will still take 14 years to reach 87% share of LDVs on the road.

OK, so maybe no one cares about my blinking orange light, but they do care about electric powertrains. What if we applied this simple logic to fleet turnover to evaluate potential penetration of electric powertrains? To find out, we ordered a few more cocktails and got back to work.

OK, so maybe no one cares about my blinking orange light, but they do care about electric powertrains. What if we applied this simple logic to fleet turnover to evaluate potential penetration of electric powertrains? To find out, we ordered a few more cocktails and got back to work.

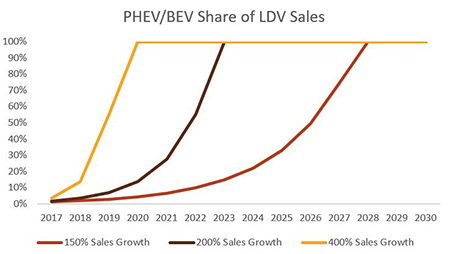

Using the EIA numbers for sales, scrappage and inventories, and starting with WardsAuto’s report that plug-in hybrids and battery electric vehicles combined represented 0.46% of LDV sales in 2016, we ran three models. We sought to understand the market impact if plug-in hybrid electric vehicle/battery electric vehicle (PHEV/BEV) sales increased market share each year by 150%, 200% and 400% through 2030. The results are interesting.

In these growth scenarios, PHEV/BEV combine to capture 100% of the LDV sales market quickly. In fact, if sales quadruple every year, every LDV sold in 2020 will be PHEV/BEV. This makes sense: Whenever you quadruple the market share of any number, it won’t take long before compounded growth takes over the market. This sales market saturation, however, does not occur until 2023 and 2028 at 200% and 150% growth rates, respectively.

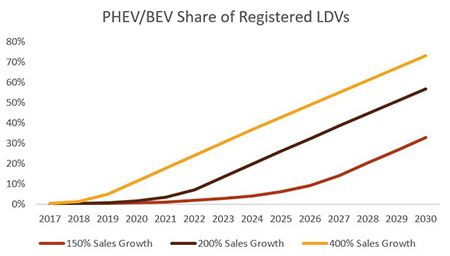

But what is more surprising is the impact these growth scenarios might have on share of the LDV fleet. In none of the scenarios will PHEV/BEV exceed 75% of vehicles on the road by 2030. Even at a 400% growth rate, which would ensure every LDV sold in 2020 and beyond was PHEV/BEV, by 2030 only 73% of cars on the road would be PHEV/BEV.

But what is more surprising is the impact these growth scenarios might have on share of the LDV fleet. In none of the scenarios will PHEV/BEV exceed 75% of vehicles on the road by 2030. Even at a 400% growth rate, which would ensure every LDV sold in 2020 and beyond was PHEV/BEV, by 2030 only 73% of cars on the road would be PHEV/BEV.

Of course, it is ludicrous to assume that every vehicle sold in the next few years will be PHEV/BEV—the industry cannot satisfy that demand and consumers are not ready. But it is amazing to realize that, even if this did happen, these vehicles still would not eclipse a 75% share of vehicles on the road by 2030.

Of course, it is ludicrous to assume that every vehicle sold in the next few years will be PHEV/BEV—the industry cannot satisfy that demand and consumers are not ready. But it is amazing to realize that, even if this did happen, these vehicles still would not eclipse a 75% share of vehicles on the road by 2030.

The market is changing, and this change is coming more rapidly every year. But I think we have time for another cocktail or two before the market changes so much it becomes unrecognizable.

John Eichberger is the executive director of the Fuels Institute and can be reached at jeichberger@fuelsinstitute.org.

The Fuels Institute, founded by NACS in 2013, is a nonprofit research-oriented think tank that evaluates market issues related to vehicles and the fuels that power them, incorporating the perspective of diverse stakeholders to develop and publish peer-reviewed, comprehensive, fact-based research projects. The Fuels Institute is a non-biased organization that does not advocate.